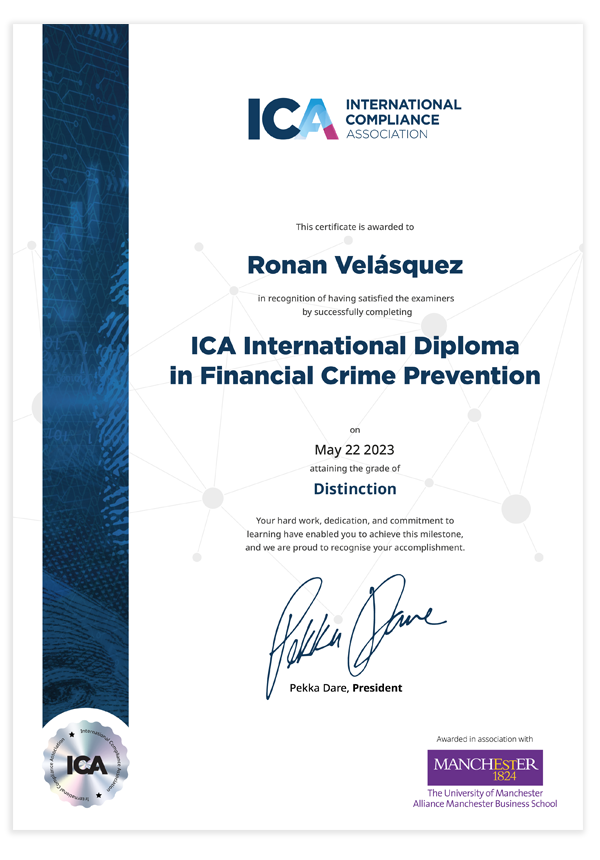

ICA Diplomas

These advanced flagship qualifications will help you manage and develop best practice initiatives.

These advanced flagship qualifications will help you manage and develop best practice initiatives.

"Choosing the ICA as my training provider was a no-brainer. They are recognised and well respected internationally, provide ample choice of qualifications, and have course tutors who are experienced and knowledgeable professionals."