By Vera Cherepanova, 21 July 2025

Corporate boards today are navigating unprecedented challenges. Rapid technological advancements, the climate crisis, and growing demands for sustainability and ethical governance have reshaped the expectations placed on board members.

Despite this shifting landscape, a troubling pattern persists: boards continue to prioritise traditional skillsets, overlooking expertise in areas critical to long-term corporate resilience – such as ethics and compliance.

At a time when compliance and regulatory risks, reputational threats, and cultural misalignment keep directors up at night, the absence of compliance professionals on boards represents a significant governance gap. It’s time to challenge the status quo and recognise the unique value compliance officers bring to the boardroom.

Current gap on boards

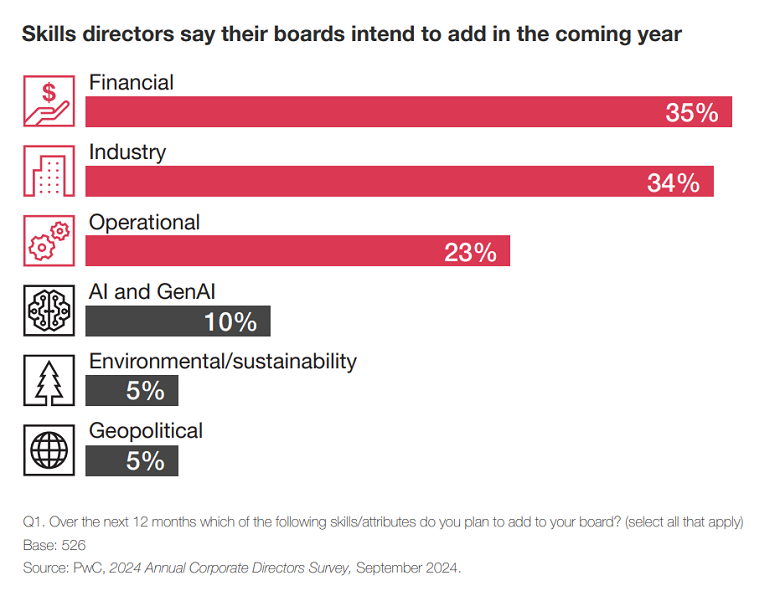

According to PwC’s 2024 Annual Corporate Directors Survey [1], financial, industry, and operational expertise dominate the list of skills directors plan to add to their boards in the coming year, with 35%, 34%, and 23% prioritising these areas, respectively.

Meanwhile, skills like AI, sustainability, and geopolitical expertise remain low on the agenda, and ethics and compliance expertise don’t even register.

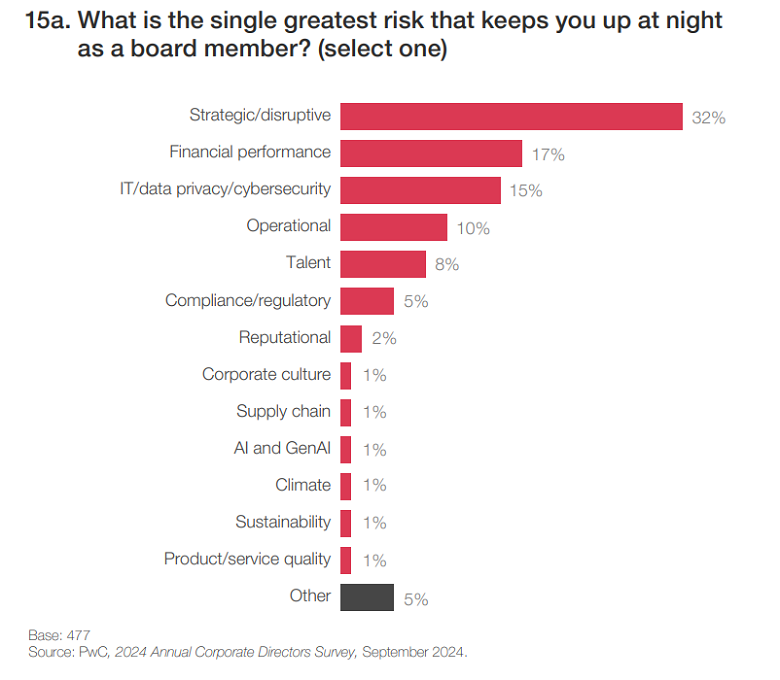

This is particularly concerning when juxtaposed with directors’ views on risk. In the same survey, compliance and regulatory risks ranked as the fifth most significant concern at 5%, while reputational and cultural risks accounted for an additional 3%. Together, these risks make up 8% of the issues directors lose sleep over, yet the skills needed to address them are conspicuously absent from board priorities.

Boards are not just overlooking compliance as a skillset; they are underestimating its strategic importance. This creates a blind spot in governance, leaving organisations vulnerable to the very risks they acknowledge as critical.

Unique value of compliance officers

Compliance officers bring a set of competencies that are uniquely suited to addressing some of the most pressing challenges facing boards today. Compliance expertise equips directors with the tools to navigate complex, interconnected risks.

Holistic risk management

Compliance professionals understand how regulatory, operational, and reputational risks intersect. They can help boards anticipate emerging threats, develop robust mitigation strategies, and foster organisational resilience.

Cultural stewardship

Boards are increasingly expected to oversee corporate culture as a driver of ethical behaviour and long-term success. Compliance officers, with their ability to translate values into actionable policies, are natural stewards of culture and integrity.

Stakeholder trust

As businesses face heightened scrutiny from regulators, investors, and the public, compliance officers provide critical insights into stakeholder expectations and help boards navigate the evolving demands for transparency and accountability.

These contributions align with the broader vision of “future-ready” boards: adaptable, value-driven, and deeply attuned to ethical considerations.

Addressing barriers to entry

Despite their value, compliance professionals face systemic barriers when it comes to board appointments. Common misconceptions – such as the belief that compliance is too tactical or operational – persist, leading boards to underestimate their strategic potential. To bridge this gap, both boards and compliance professionals must take action.

- Boards: Incorporate compliance expertise into board matrices and actively seek out candidates with compliance backgrounds, ensuring diversity in governance.

- Compliance professionals: Reframe their experience to highlight strategic contributions, such as driving cultural transformation or aligning organisational goals with stakeholder expectations.

- Investors: Include the presence of ethics and compliance leaders on boards as a key investment criterion, signalling a commitment to robust governance and long-term value creation.

A vision for Boards of the Future

At Boards of the Future, we advocate for a new paradigm in corporate governance – one where diverse skillsets, including ethics and compliance, are not only valued but essential. By challenging traditional norms and broadening the pool of board candidates, we can build governance structures better equipped to address the uncertainties of the 21st century.

This mission is not just about filling seats; it’s about redefining what it means to be “board-ready.” Compliance officers bring a perspective rooted in integrity, accountability, and ethical leadership – indispensable for creating long-term sustainable value.

The risks facing boards today demand more than financial and operational expertise. They require a commitment to building governance structures that reflect the complexities of the modern business landscape.

Boards have an opportunity to embrace compliance officers as key contributors to effective governance, while compliance professionals have a responsibility to step forward and claim their place at the table.

I’m hopeful our work will inspire current and aspiring board members to reflect on the skills they need to cultivate and lead companies through future storms with integrity and purpose.

About the author

Vera Cherepanova is the Executive Director of Boards of the Future, a global non-profit advocating for increased representation of risk, ethics, and compliance professionals on corporate boards. She is also the founding partner of Studio Etica, a boutique consultancy advising companies worldwide on corporate ethics and compliance programmes.

This article has been republished with permission from Compliance and Ethics: Ideas & Answers, whose aim is to contribute to the compliance and ethics profession, to champion compliance and ethics professionals, and to help them do their difficult jobs.